If you’ve found out your data has been compromised, don’t panic – but don’t ignore it either. This guide walks you through exactly what to do next. From spotting scams to making a claim, we’re here to help you take back control.

Your info’s out there – now what?

Whether it’s a leaked email address, stolen passwords, or worse, a data breach can leave you exposed to scams, ID fraud, and credit damage. But you’re not powerless.

This guide explores what you can do right now to protect yourself and hold the offending organisation accountable.

Your personal data is valuable – and vulnerable. Every online purchase, sign-up form, loyalty scheme, and social media interaction adds to a complex profile of who you are – your habits, preferences, location, and identity. And when that data falls into the wrong hands, the impact can range from annoying to devastating.

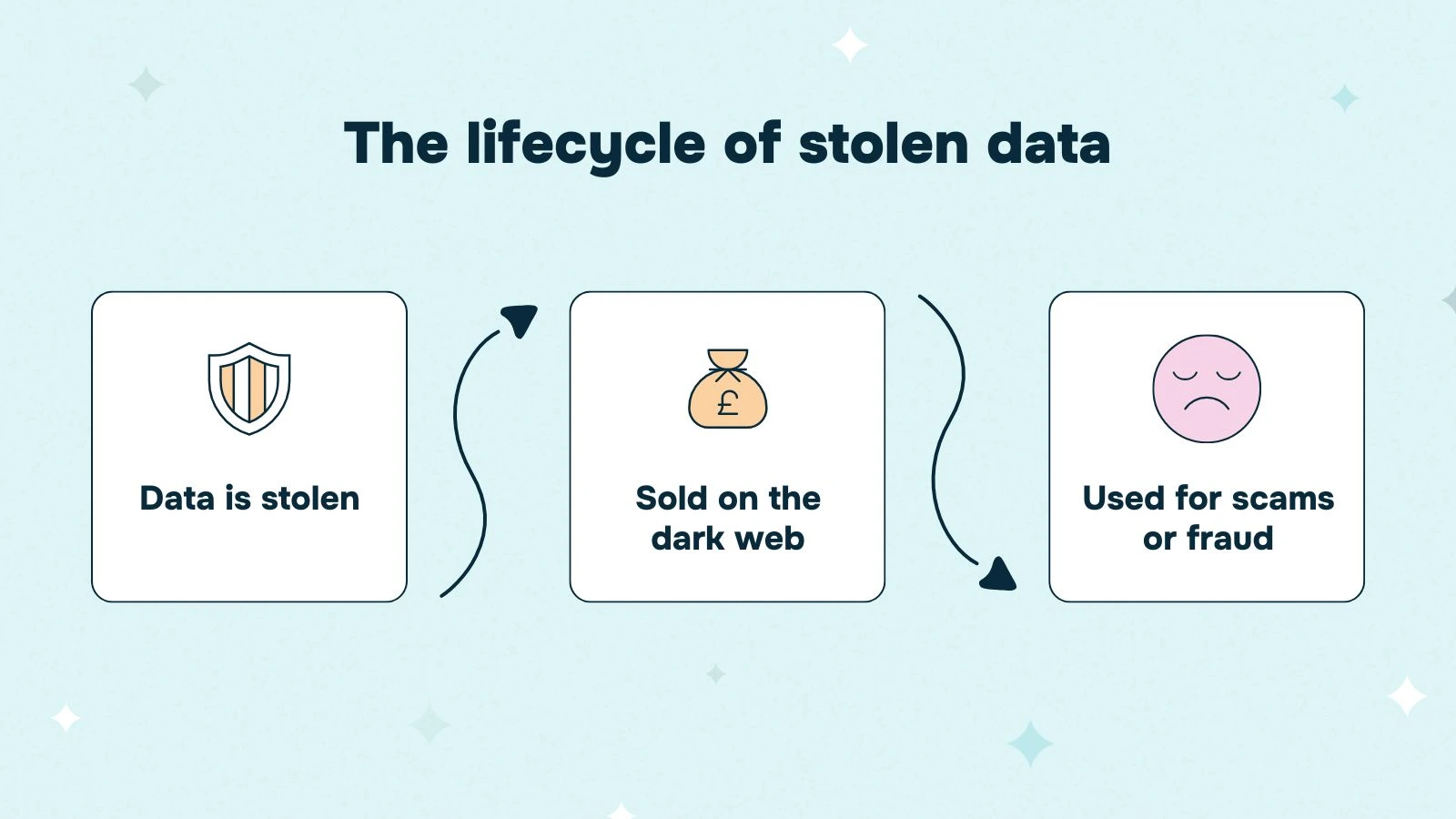

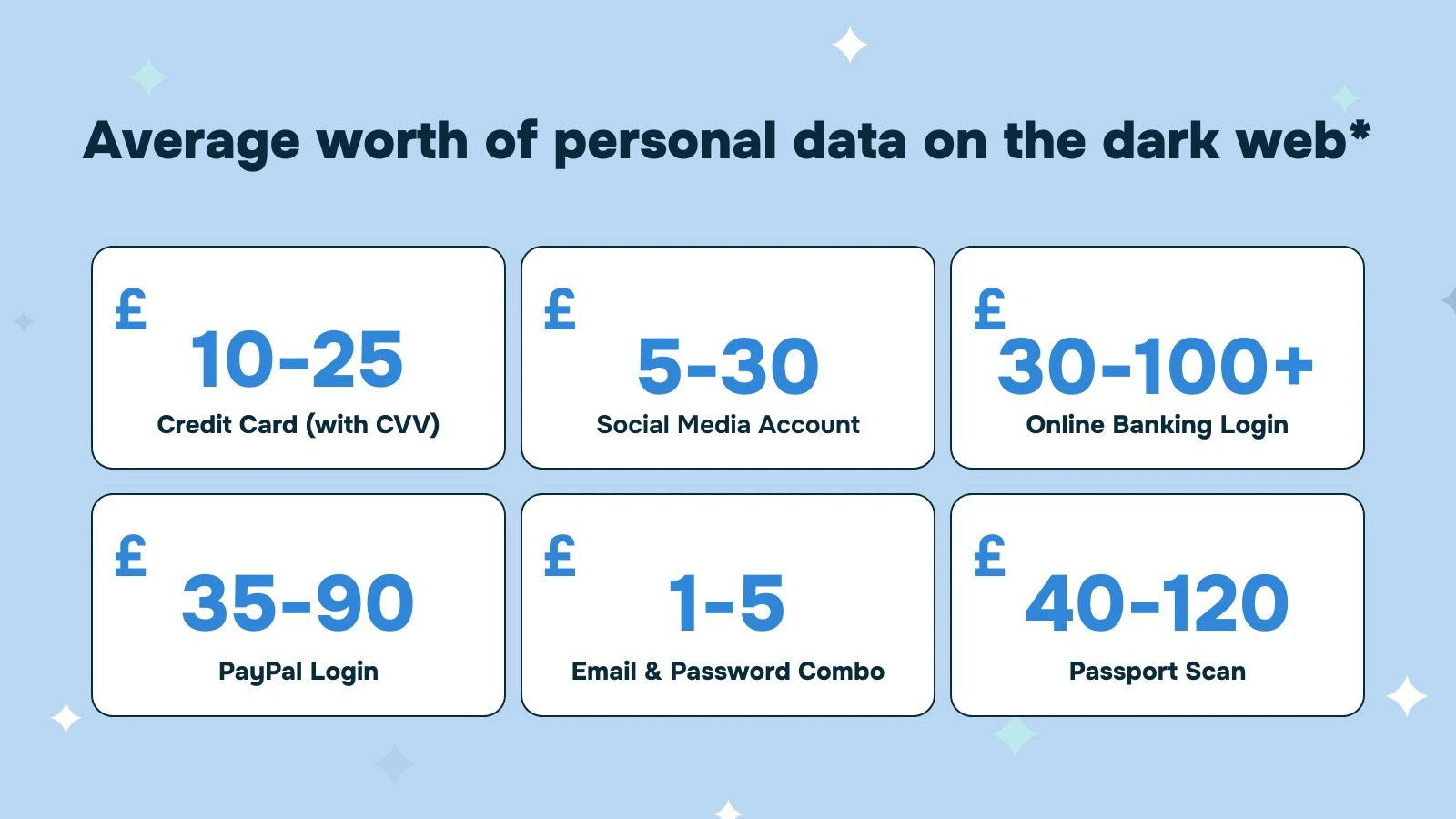

Stolen personal data is often sold on the dark web. A breached email address might fetch just a few pence, while full identity kits – including names, addresses, birthdates, and bank account details, command much higher prices. Criminals can mix and match data to build realistic profiles that bypass security systems and trick even cautious individuals. So, even minor breaches can have far-reaching consequences.

If you’ve been notified of a data breach, or suspect your personal data has been compromised, it’s essential to act quickly. Taking the right steps early can reduce your risk of financial loss, help you regain control, and strengthen any future legal claim.

Here’s what to do now:

Start with the account that was directly involved in the breach. Then move on to any other accounts where you use the same or similar login credentials. Consider using a password manager to create strong, unique passwords across your accounts. Turn on two-factor authentication (2FA) wherever possible as this adds an extra layer of security.

Be wary of unsolicited calls, emails, or texts asking for further personal information. Scammers often use breached data to build trust and trick people into giving up more details. Fraudsters might pretend to be from your bank, service provider, or even the organisation that suffered the breach. If something feels off, hang up and call back using an official number.

Cybercriminals often use data stolen in breaches to carry out phishing attacks and gain access to more personal information. These scams involve emails or messages that appear to be from legitimate sources but contain malicious links. To protect yourself:

Check your online banking and credit card statements for any transactions you don’t recognise. Contact your bank immediately if something looks suspicious. It’s also wise to check your credit report and consider signing up for a credit monitoring service, especially if sensitive financial data was exposed.

Banks, credit card companies, and service providers often have dedicated response teams for handling breaches and can help you take steps to secure your finances. They may also offer support in monitoring your accounts or providing recommendations on securing your data.

If your financial data may have been compromised, consider placing a fraud alert with credit reference agencies like Experian, Equifax, and TransUnion. This warns creditors to take extra verification steps before approving credit requests.

If you believe you’re at high risk of identity theft, consider placing a credit freeze on your report. This prevents lenders from accessing your credit report, making it more difficult for criminals to open new accounts in your name. You can request a freeze through the main credit reporting agencies. A freeze can be lifted temporarily or permanently if you decide to apply for credit in the future, giving you more control over your information.

Services like HaveIBeenPwned.com can help you check whether your email or login credentials have been exposed in previous breaches.

If the organisation hasn’t clearly explained what personal information of yours was involved in a breach, you can submit a formal SAR under the UK GDPR. Ask for a detailed explanation of what happened, when the breach occurred, what data was involved, how you might be affected, and what they’re doing to fix it.

Often, companies that experience a breach will provide advice or support to affected individuals. Follow any recommended steps to secure your data. If they offer free services, consider taking advantage of them to bolster your security. But make sure you don’t give away your rights to pursue compensation by accepting these offers.

If the breach involved highly sensitive personal or financial information, consider signing up for identity protection services that alert you if someone tries to use your details fraudulently.

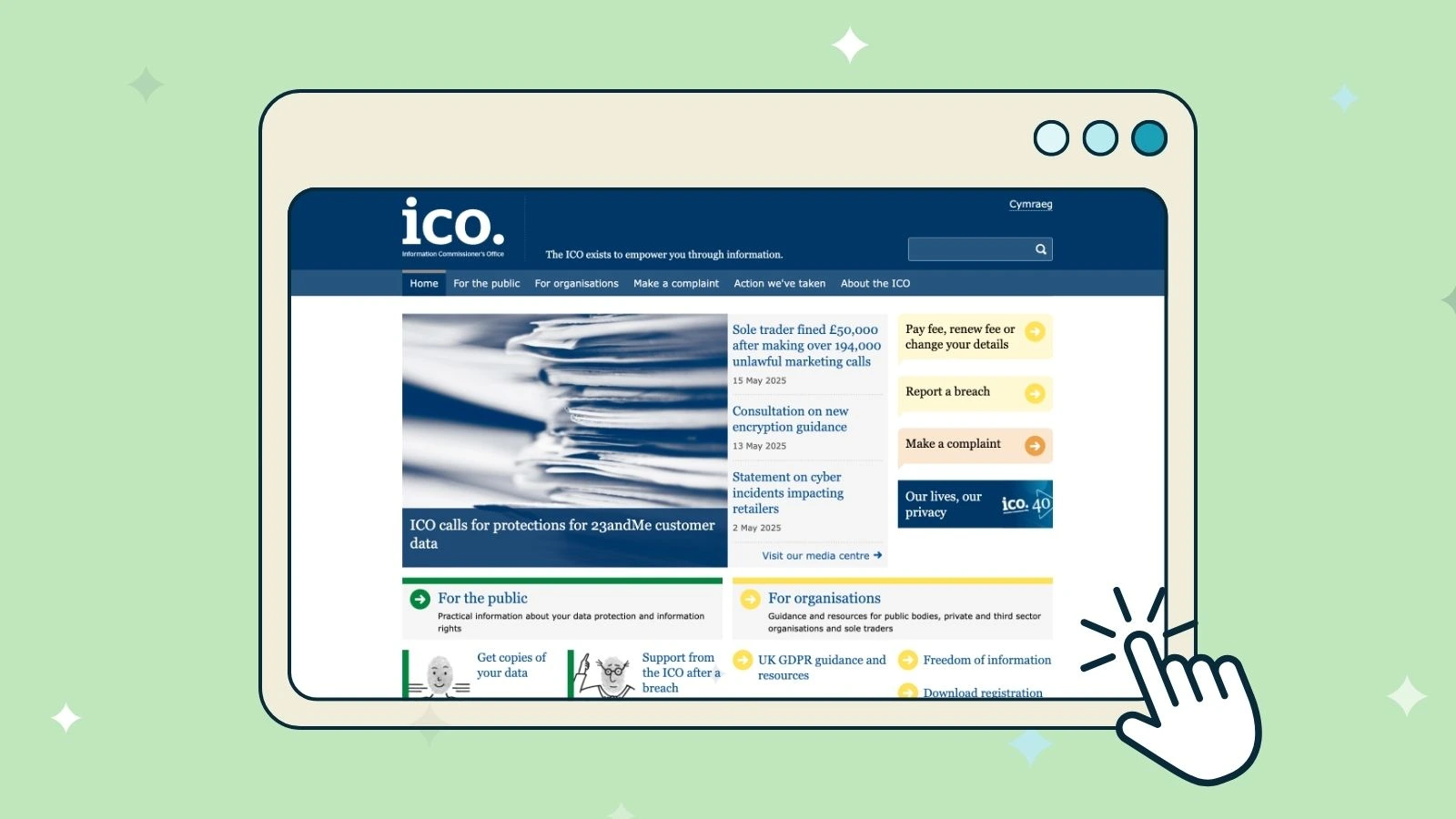

If an organisation has breached your data, if you’re unhappy with how they are handling the breach, if they failed to notify you properly, or won’t provide information, you can report the matter to the Information Commissioner’s Office. The ICO won’t award compensation, but it can investigate and fine the organisation if it finds wrongdoing.

Keep a written record of what happened and how it has affected you. This includes emails or letters from the organisation that breached your data, receipts or costs incurred, evidence of identity theft or fraud, and notes on your emotional response (such as stress, anxiety, or lost sleep). This kind of documentation can help support a future legal claim.

In large-scale breaches, group legal actions often form, and you might be eligible to join. A trusted platform like Join the Claim can keep you informed about any live no-win, no-fee claims.

Recovering from a data breach can feel isolating, but help is out there:

The ICO website is a vital resource for understanding your data protection rights. It offers practical advice on how to report a breach, how your case will be investigated, and what organisations are legally required to do to protect your data.

Sometimes, the best advice comes from people who’ve been through it themselves. Online support groups, forums, and advocacy communities can help victims of data breaches feel understood and less alone. These spaces offer reassurance, tips, and guidance, helping you navigate the road to recovery.

If you’ve been affected by a data breach, you could be eligible for compensation. Join the Claim connects you with trusted UK law firms that can help you hold organisations accountable. Check out the latest data breach claims on our website.

Citizens Advice can offer practical support and guidance if you’ve suffered financial harm or need help navigating your next steps. They can also assist with writing formal complaints and escalating unresolved issues.

If you’re feeling distressed, anxious or unsafe following a breach or scam, Victim Support offers free and confidential emotional support to help you cope and move forward. Visit www.victimsupport.org.uk to find out more.

After a data breach, cybercriminals often use stolen information to perpetrate scams. Here are some common scams to watch out for:

Be extra cautious following a data breach, and verify all unsolicited communications through official channels.

If you discover you’ve been scammed following a data breach, it’s crucial to act immediately.

Action Fraud is the UK's national reporting centre for fraud and cybercrime. Report the incident as soon as possible. After reporting, you'll receive a crime reference number, which is vital for liaising with banks and financial institutions and may be needed for insurance claims.

Inform your bank or financial institution about the scam. They will typically freeze affected accounts, monitor for fraudulent activity, and may reimburse lost funds if you act quickly.

The cost of a data breach often goes far beyond the initial inconvenience of a compromised email or a suspicious phone call. For many people, the experience is profoundly unsettling and can trigger a cascade of problems that affect their finances and their emotional wellbeing.

If your banking information has been accessed, fraudulent transactions may follow. Even after resolving those, victims often face challenges applying for credit or loans. Identity theft, once it takes root, can result in long-term complications such as incorrect entries on your credit file, debt collection notices for accounts you didn’t open, or loss of access to services.

Cybercriminals often steal personal information to sell it on the dark web, where it can be used for identity theft, fraud, or other illegal activities.

*Various sources

The emotional toll can be severe. Victims frequently report heightened anxiety, loss of sleep, and a sense of helplessness. Even when no financial harm has yet occurred, the knowledge that someone could be impersonating you or accessing your personal life can be deeply distressing. There is a psychological impact to knowing that details like your home address, medical history, or even private messages may be circulating in places you have no control over.

Many victims spend hours – sometimes days or weeks – contacting banks, changing passwords, speaking to fraud departments, and monitoring credit reports. This administrative labour often goes unnoticed in compensation calculations, but it’s a very real form of harm that disrupts daily life.

For some, there are professional consequences. A breach involving employment data or disciplinary records, for example, can undermine career prospects or workplace relationships. For people in sensitive roles, the exposure of work-related data may even put their safety at risk. For example, leaked information about police officers, judges, or key workers could lead to targeted threats or harassment, turning a breach into a direct danger to their lives.

Prolonged stress and financial strain can affect sleep patterns, blood pressure, and overall wellbeing. The psychological impact of a data breach is well documented, but in some cases, the consequences are more immediate and physical. For example, if the home addresses of vulnerable individuals – such as domestic abuse survivors – are exposed, it could put their personal safety at risk.

Seeking compensation for a data breach isn’t just about getting money back, it’s about holding organisations accountable. Here’s how the process typically works:

If you suspect a breach but haven’t been notified of one, your first step is to contact the organisation responsible. They’re required by law to investigate and provide you with details of what happened.

If the offending organisation contacts you to alert you to a data breach, make sure they provide all the above information. If it fails to provide sufficient information or takes a dismissive approach, escalate the issue to the Information Commissioner’s Office (ICO).

The ICO can investigate the breach and ensure the organisation takes its responsibilities seriously. It also hands out hefty fines in serious data breach failures. And, while it doesn’t award compensation to data breach victims, solicitors use evidence uncovered by the ICO to support their data breach lawsuits.

Document everything related to the breach to strengthen any potential data breach claim. This includes:

A solicitor specialising in data breaches can assess your case and guide you on the best way to proceed. Large-scale breaches often result in group litigation actions. Group litigation allows individuals affected by the same issue – in this case, a data breach – to unite in a single legal claim.

Joining one of these claims can make the process simpler and reduce costs. Even better, many lawyers offer no-win, no-fee agreements in group cases, meaning you won’t pay unless your claim is successful.

To join a data breach group claim, you must meet specific criteria. Join the Claim offers straightforward checks to determine eligibility, and simple sign up procedures.

Once the group action is underway, the law firm representing the group will negotiate on behalf of all claimants. The aim is often to reach a settlement without going to court, especially in cases where companies want to avoid the negative publicity and expense of a trial.

If a settlement is reached, it usually involves compensation being awarded to the affected individuals. If no settlement is reached, the case may go to trial. In this scenario, the group will continue to be represented by the law firm, which will present the case in court on behalf of all claimants.

If your claim succeeds – either through a settlement or court judgment – you’ll be awarded compensation. This can cover:

Staying safe online isn’t about paranoia, it’s about awareness. By taking a few simple precautions, you can reduce your exposure to future data breaches, and be better prepared to respond if something goes wrong.

Only share your personal data when absolutely necessary, and only with organisations you trust. Ask yourself: Do they need this information? How will it be used? Are there alternative ways to proceed without handing over sensitive details?

Take stock of the organisations and platforms you’ve shared your data with. Consider closing old accounts you no longer use, limiting the amount of personal data you give out, and revisiting privacy settings on social media and service apps. The less data you have floating around, the less there is to be breached.

Avoid reusing passwords across accounts. To stay safe:

Two-factor authentication (2FA) adds an extra layer of security by requiring a second form of verification (like a text code or fingerprint). Enable it on all accounts that offer it, especially email, banking, and social media.

Outdated software often has security vulnerabilities hackers can exploit. Regularly updating your devices and applications helps protect them from these threats. Enable automatic updates whenever possible to ensure your system has the latest security patches.

Antivirus and anti-malware programs can detect, block, and remove potential threats before they can cause harm. Many options are available, from free versions to premium packages. Choose a reputable provider, keep the software updated, and run regular scans to catch threats early.

Phishing emails, texts, and phone calls remain one of the most common ways attackers gain access to your data. Look out for misspellings, urgent demands, or unfamiliar links. If something feels off, it probably is – so don’t click.

Social media is a goldmine for fraudsters. Avoid sharing personal details like your full date of birth, address, or pet names – especially if those details are also used in your passwords or security questions.

When using public Wi-Fi – for example at a coffee shop, airport or hospital – hackers can more easily intercept your internet activity. So never share sensitive data using a public wireless connection. If you do want to securely use public Wi-Fi, use a reputable VPN service to encrypt your connection and make it harder for others to access your data.

Most apps and platforms give you some control over how your data is used. Review your settings, especially on social media, and turn off unnecessary tracking or data-sharing features.

Consider setting up alerts with your bank or credit agency to notify you of unusual activity. Check your credit report regularly, and use services that alert you if your email or passwords appear in known data leaks.

Keep an eye on jointheclaim.com. We regularly alert people to new data breaches they might be involved in.

Data breaches are unsettling, but swift action can significantly mitigate their impact.

Even if the data breach happened some time ago, you may still be eligible to take legal action. Many breaches only come to light months – or even years – after they occurred. If you’ve received a notification or suspect your information was involved in a known incident, you may be able to join an existing group action.

Moving forward, proactive measures and understanding your rights are the best defence against data misuse. Stay informed, regularly review your data security practices, and don’t hesitate to seek professional help if needed.

Bee is the content lead at Join the Claim, where she helps people understand their rights and take action when they’ve been wronged. With a background in PR, copywriting, and content strategy, she’s spent over a decade writing about legal matters – turning complex topics into clear, accessible resources that inform and empower.

From writing about data breaches to explaining how group claims work, Bee’s goal is always the same: to give people the confidence they need to take the next step. She’s committed to making legal information feel human, relevant, and easy to trust.

Disclaimer

This guide is intended for informational purposes only and does not constitute legal advice. Join the Claim is not a law firm. We provide a platform to raise awareness of consumer issues and connect individuals to legal information, investigations and potential claims as they develop. Registering your interest does not create a solicitor-client relationship.

Last Updated: 23 June 2025

Sign up for our newsletter to stay up to date.

We connect consumers with their legal dream teams to ensure they get the compensation and support they deserve.

Join the Claim is not a law firm. We connect individuals with top law firms for group action claims, and our service is free to use. While we may receive a fee from the law firms we introduce you to, this will not affect your costs or compensation. We are not responsible for the advice or services provided by these firms. Please note, nothing on this website is legal advice, and while we check claim eligibility, we cannot guarantee a law firm will accept a case.

Join the Claim is a registered trading name of Big on Media ltd. Big on Media is registered in the United Kingdom under licence number 09878028 with its registered office located at Big on Media, 6 Sunderland Street, Tickhill, Doncaster, DN11 9QJ

© Join the Claim All Rights Reserved | 2025